16 April 2023

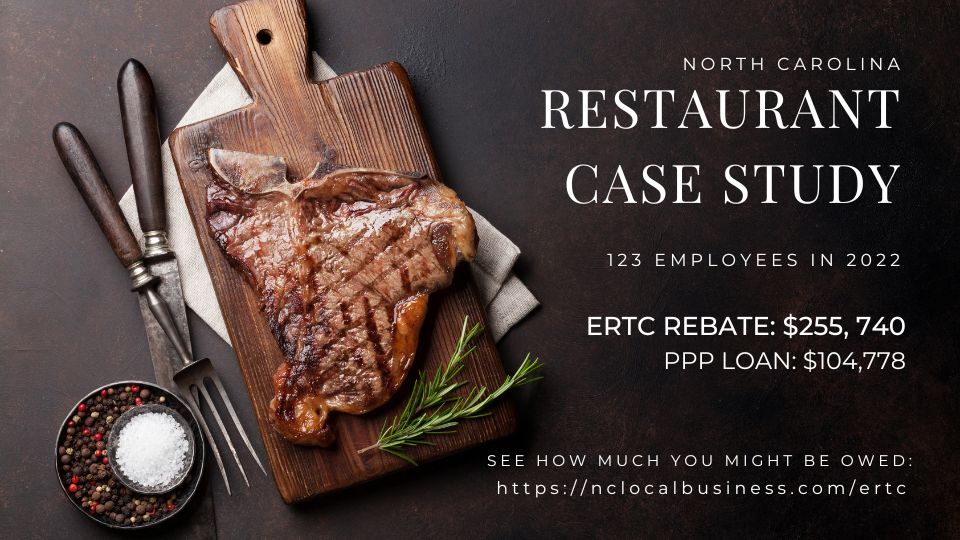

Right now, over 10,000 small businesses all over the country have received between $20,000 and $3,000,000 in just the past 12 months.

And it’s money the business owners are free to do what they want — that doesn’t have to be paid back to the government — that really helps cash flow.

Skip ahead and see if your business qualifies…or read on to learn more…

We’re working with a CPA firm to help business owners find out about this little-known government tax program called ERTC (Employee Retention Tax Credit), because our mission is to help small businesses in North Carolina thrive.

The best part is these funds never have to be paid back.

ERTC is a government program that rewards businesses for paying employees during the pandemic (2020-2021). If your small business hasn’t already amended the proper forms to recover the excess payroll paid in those years before the tax law changed, you’re leaving money on the table…even if you already received PPP loans, you are still owed this money.

From the IRS:

- Eligibility Guidelines Website

- Eligibility Guidelines PDF

- Warning on filing false claims or improper filings

What business wouldn’t benefit from this surge of cash? That’s why we are trying to make you aware of the ERC and the calculator created by the top ERC specialists:

- They triple check filings – if 3 CPA teams don’t get the same calculation, they don’t file. It has to be correct.

- They’ve made presentations to educate the American Institute of Certified Public Accountants.

- They sign their license on each submission, and offer audit defense — and after 25,000 filings they haven’t had an audit yet (going back to the getting it correct part in the first bullet).

Time is of the essence because it may take months to process with the IRS and the window is shrinking.

Most business owners haven’t even heard of it.

And the government hasn’t done a good job of getting the word out about it it. So most local business owners haven’t heard of it!

Many CPA’s are only applying for revenue losses, but in reality, there are many other reasons you may qualify like supply chain disruption and social distancing. You can maximize your claim by working with a specialist in this program.

We learned about it from a local business owner and thought every business owner needed to take advantage of this program.

If you have a friend that owns a business and has employees and pays out W-2 wages, then do them a huge favor and forward this page, so they can also take advantage of this program. They will thank you for thinking of them and helping them get connected for their own ERTC Funding.

Here are some resources where you can learn more:

- Calculate an estimate for the maximum $-amount your business could qualify

It’s complicated though.

- Many CPA firms aren’t touching it because of its complexity.

- Some CPA’s have mistakenly thought their clients didn’t qualify (but they actually did once an ERTC specialized CPA team got into the fine details).

If you paid W-2s, your business might qualify!

Most North Carolina businesses were affected in one way or another by the negative effects that Covid had on the economy, but the good news is that the government has made it much easier to qualify for this ERTC Funding and because of recent changes, now more businesses can qualify.

If you have W-2 employees, that you paid wages to during the pandemic in 2020 and/or in 2021, then you probably also qualify for ERTC Funding too.

You can find out if you’re leaving money on the table.

Even if you got PPP loans.

Even if you didn’t loose money during the pandemic.

There might be quarters where your business showed a loss, and an ERTC specialized CPA might be successful in finding unclaimed money that is owed to your business too.

Key ERTC Eligibility Criteria Every Business Owner Should Know

Many businesses experienced a significant decline in gross receipts and were subject to government-mandated full or partial suspension of operations due to COVID-19. There are many ways beyond revenue losses that a business can qualify.

For example, your business might qualify if you experienced:

- Decrease in revenue

- Capacity or travel restrictions

- Group gathering limitations

- Customer or jobsite shutdowns

- Customer or vendor restrictions

- Supply chain disruptions

- Full or partial shutdowns

- Remote work orders

Don’t dismiss and ignore this, because this ERTC Funding is very real, and you most likely qualify for it and can use it right now in your business.

It takes about 1 minute to complete the simple 9 question Initial Inquiry Form that helps the expert ERTC Accounting Team assess whether your business qualifies or not. If it does, then they will reach out to you to explain the whole process in more detail and request the other information you will need to provide.

Once you submit the information they need, they can turn around your application and get it filed with the IRS in about 2-4 weeks, and then the IRS will review the application and process your Funds and send you your ERTC Check.

It is quick to get started. Just go to this website for more information and you can fill out the Initial Inquiry Form at the bottom of the website and someone from their Team will be back in touch with you shortly.